An ESRI study indicates people tend to go for mortgages that do not offer value in the long run.

The behavioural research for the Central Bank says attractive mortgage offers often have hidden expenses.

Meanwhile, it has also found that the amount consumers repay on credit cards is influenced by minimum amounts suggested by lenders.

This can also lead to people paying more in fees and interest than they intend.

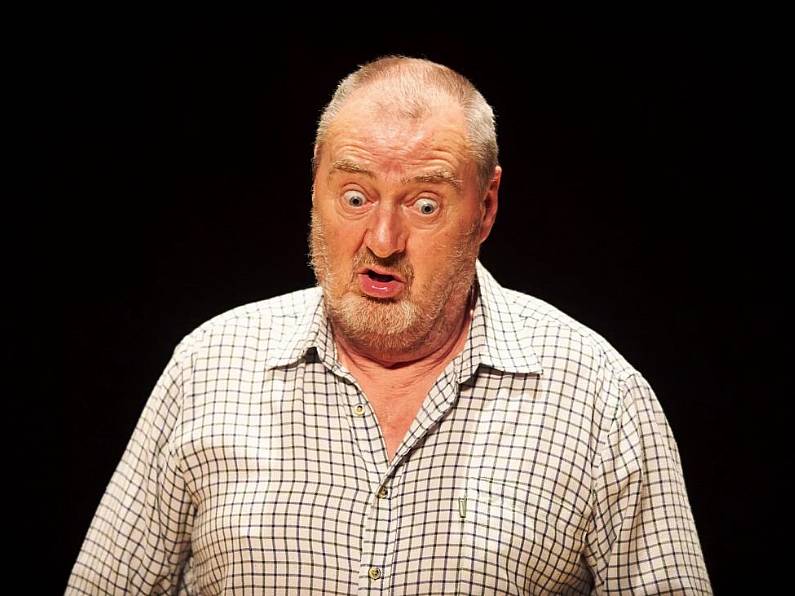

Professor Pete Lunn from the ESRI said credit card holders seem to use their credit limit as a target.

He said: "If a company increases their credit limit, then often the consumer takes that as a signal that they ought to be borrowing more, it's okay for them to borrow because they are uncertain about it.

"Now these days they are supposed to write to the consumer to tell them that they are doing that, but quite often people take the credit limit as a signal about how much they are kind of advised to borrow, rather than what the limit of their borrowing is."