Budget day is here and we'll be feeding you live updates on the facts & figures that matter most to you.

What you need to know:

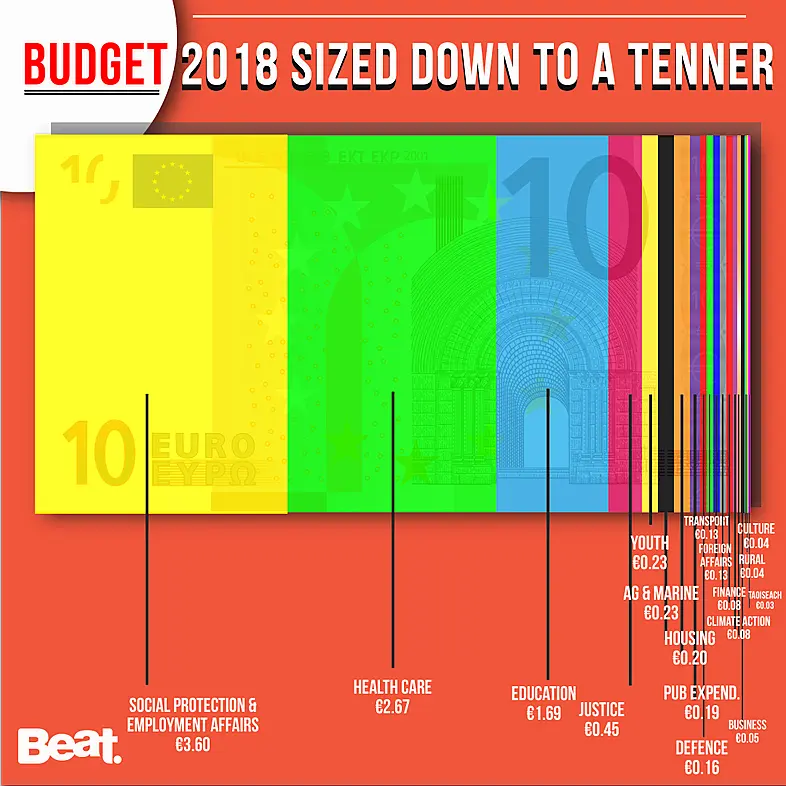

- 60.9 billion euro expenditure projected for 2018.

- 3,800 new social homes to be built next year.

- €18 million increase to the budget for emergency accommodation.

- Commercial Stamp duty is tripling from 2% to 6% from midnight tonight.

- Mortgage relief will be lowered to 75%.

- An extra 1,800 frontline HSE staff.

- Prescription charge to go from 2.50 euro to 2 euro.

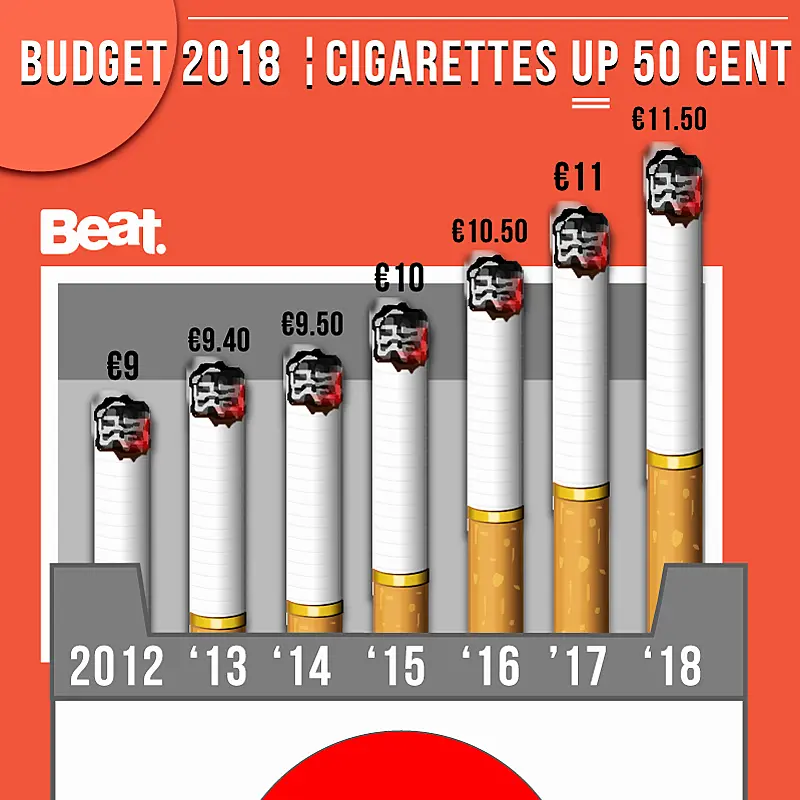

- Cigarettes to increase by 50 cent.

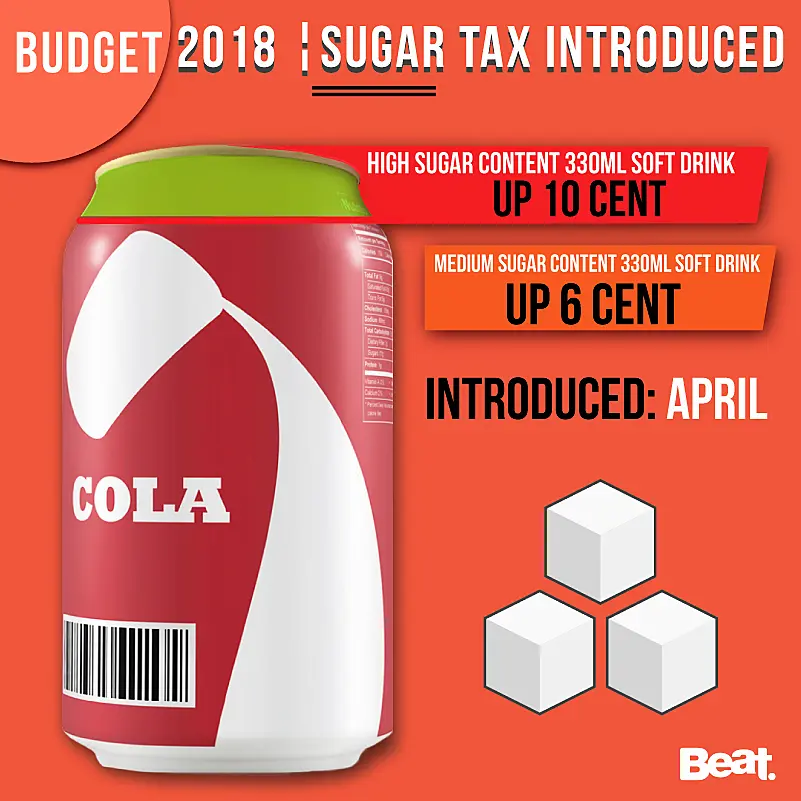

- Progressive sugar tax to be introduced.

- 1300 extra teaching posts in schools across Ireland next year.

- 800 extra Gardai to be recruited.

- Sunbed VAT rate to be increased.

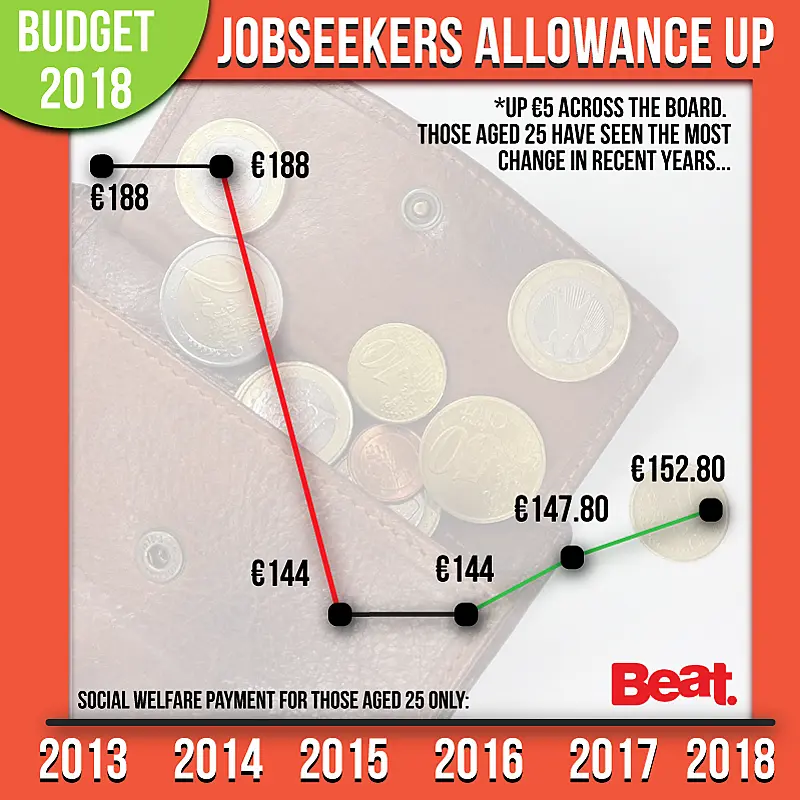

- Social Welfare payments to go up by five euro per week across the board.

- Christmas Bonus to remain at 85%.

- Changes to USC.

- Entry point to USC remains at €13,000. The 2.5% rate will be lowered to 2% with the ceiling for this rate raised from €18,772 to €19,372. The 5% USC rate lowered to 4.75%.

- Carers Allowance to increase to €1,200 per anum.

- Low to middle-income workers will no longer be penalised for working overtime.

USC Cut: What will you save per year?

________

13:10 - Economic growth stands at 4.3% in 2017 and will reach 3.5% in 2018. Unemployment to fall to 5.7% in 2018.

13:11: Unemployment to fall to 5.7% in 2018.

13:11: 60.9 billion euro expenditure projected for 2018. That's €12,700 per person in the country. This is central to Ireland's reaction towards Brexit.

13:13: Pascal O'Donoghue says ramping up capital expenditure would be a dangerous decision.

13:14: Introduction of a new rainy day fund with a 1.5 billion euro injection to kick start it.

13:15: Capital Spending will be €5.3 billion in 2018. That's up €790 million on 2017. There'll be €4.3 billion more directed towards the current Capital Plan over next 4 years.

13:16: Total budget 2018 package is €1.2 billion.

13:17: Total tax reductions in Budget 2018 on income will total €335 million.

13:19: €1.83 billion will be directed towards housing in 2018 with the aim of building 3,800 new social houses next year. The HAPS scheme getting additional €149 million to support an additional 17,000 households in 2018.

13:21: €18 million increase to €116 million budget for emergency accommodation.

13:22: NAMA to be wound down.

13:24: Commercial Stamp duty is tripling from 2% to 6% from midnight tonight

13:25: A 3% levy for the 1st year of vacant site will double to 7%. Any landowners who don't develop in 2018 will pay 3% in 2018 but 7% from 2019 on.

13:28: Mortgage relief will be lowered to 75% for 2018, 50% 2019 and 25% in 2020.

13:28: Increase of €685m in Health spending in 2018 bringing total to €15.3bn for 2018.

13:28: Funding for an extra 1,800 frontline HSE staff.

13:29: Prescription charge to go from 2.50 euro to 2 euro.

13:30: An extra 50c on a pack of 20 cigarettes.

13:31: 30 cent tax on a litre of fizzy drinks with 8g per 100ml and a 20 cent tax on a litre of fizzy drinks with 5-8g per 100ml.

13:32: 1300 additional teaching posts in schools in 2018.

13:33: 1000 extra special needs teachers to be hired by Sept 2018.

13:35: 800 extra Gardai to be recruited in 2018, while an additional 500 civilians to also be hired into the force.

13:36: Brexit Loan Scheme for SMEs has been announced with €300 million to be available to them at competitive rates.

13:37: Sunbeds - VAT rate to increase to 23%, "in recognition of a clear link between sun beds and skin cancer", the Minister said.

13: 38: No change to VAT rate in the tourism and services sector.

13:40: €2.5m for Irish language training in 2018.

13:45: 40m in extra funding for child protection.

13:46: Social Welfare payments to go up by five euro across the board.

13:49: Christmas Bonus to remain at 85%.

13:50: The Minister is also increasing the threshold for receipt of the Family Income Supplement by €10 per week for families with up to three children.

13:51: Point of entering higher income tax rate will be raised by €750 from €33,800 to €34,550.

13:52: Entry point to USC remains at €13,000. The 2.5% rate will be lowered to 2% with the ceiling for this rate raised from €18,772 to €19,372.

13:53: The 5% USC rate lowered to 4.75%

13:55: Carers Allowance to increase to €1,200 per anum.

13:56: Low to middle-income workers will no longer be penalised for working overtime.