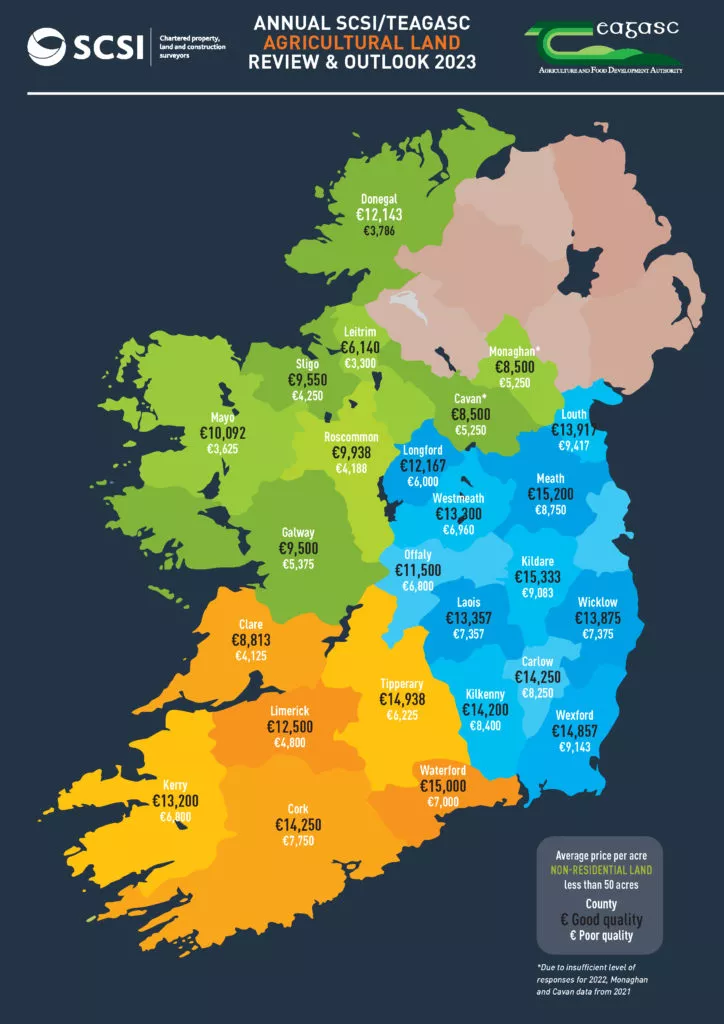

The cost of agricultural land across Ireland is expected to increase by an average of 8 per cent this year, a survey by auctioneers suggests.

Agri-auctioneers and valuers from the Society of Chartered Surveyors Ireland (SCSI) indicated that national rental prices will rise by an average of 14 per cent.

The figures are contained in the SCSI/Teagasc Agricultural Land Market Review and Outlook Report 2023, which analyses the sector’s performance over the past year and projects how it will fare in the coming year.

According to the report, which surveyed 134 auctioneers and valuers, the outlook for dairy farmers is expected to ease while the future is challenging for sheep and tillage farmers.

Strong demand driving the market

In 2022, the average agri-land rental prices in Munster and Leinster rose by 13 per cent and 9 per cent respectively.

In Munster, where land rental values increased on average by 13 per cent last year, prices per acre ranged from €241 for grazing only to €383 for potato crops.

In Leinster, rental values rose on average by 9 per cent and ranged from €248 for grazing only to €439 for potatoes.

The report indicates that the average non-residential farmland prices in 2022 ranged from €5,564 per acre for poor quality land – up 5 per cent from €5,308 in 2021 – to €11,172 per acre for good quality land – up 2 per cent from €10,962 the previous year.

Peter Murtagh, chairman of the SCSI’s rural agency committee, said strong demand from dairy farmers for good quality land is driving the market.

“Eighty-three percent of agents in our survey believe there is likely to be an increase in demand from dairy farmers to purchase farmland in 2023 and they are continually ranked throughout the survey as being the most likely purchasers of land across the country,” he said.

“However, as outlined in this report, it’s also likely that changes to the European Nitrates Directive, particularly measures aimed at protecting water quality, will have an impact on land prices, especially rental prices.

“In order to maintain current levels of milk production – and to comply with the directive – many dairy farms will need to either increase their land area or reduce milk production.

“We’d expect the impact on sales and rental prices will be more acute in regions where dairy is the dominant farm enterprise and where stocking rates are higher.”

Teagasc economist Dr Jason Loughrey said Russia’s invasion of Ukraine is continuing to have an impact on costs in the agricultural sector.

“As in many other countries, the invasion resulted in higher energy and fertiliser prices for farmers here in Ireland, and these have remained at elevated levels despite some modest declines in recent months.

“The increased cost of many key inputs was a major concern throughout 2022, but these were counterbalanced by record milk prices and by significantly higher grain and meat prices.”

“However, the price output picture this year is more difficult,” he added.

“For example, milk prices have declined from their record levels and, while still high by historical standards, the average net margin per litre is set to fall below 15 cent this year.

“While a modest overall increase in milk production is forecast, recent changes to the Nitrates Directive will limit the extent of any growth.

“On the other hand, prices for beef and pork are forecast to be higher compared to last year, with margins and incomes on cattle-rearing farms predicted to rise significantly this year.

“However, the margins on sheep farms are expected to decline this year, while the outlook for tillage farms also appears difficult, with futures markets indicating significant declines in output prices at harvest time.

“Based on those projections, the expectation is that cereal-based net margins will be negative on approximately 50% of specialist tillage farms this year.”

Written by Gráinne Ní Aodha, PA

Keep up to date with all the latest news on our website Beat102103.com.