Consumer optimism around household finances remains strong but there are economic worries ahead in 2019.

The latest KBC Bank/ESRI Consumer Sentiment Index shows that confidence remained high through December.

However, this was offset by worries for the next 12 months, with Brexit uncertainty at the forefront of people's minds.

According to the survey, the findings for December show that consumers are struggling to weigh the risk of an uncertain Brexit against the reality of modest gains in spending power that might allow some seasonal uplift in spending.

The Index was unchanged last month from its November reading of 96.5.

The findings detail that the current level of the sentiment index "is consistent with an increasingly cautious but still broadly positive mood among Irish consumers".

However, it notes that this is only the second time in the past eight years that the December reading has been lower than that of twelve months earlier.

Despite this, all three elements of the survey related to household finances were stronger in December than in November.

It is expected that "solid rather than spectacular gains in consumer spending" will continue this year.

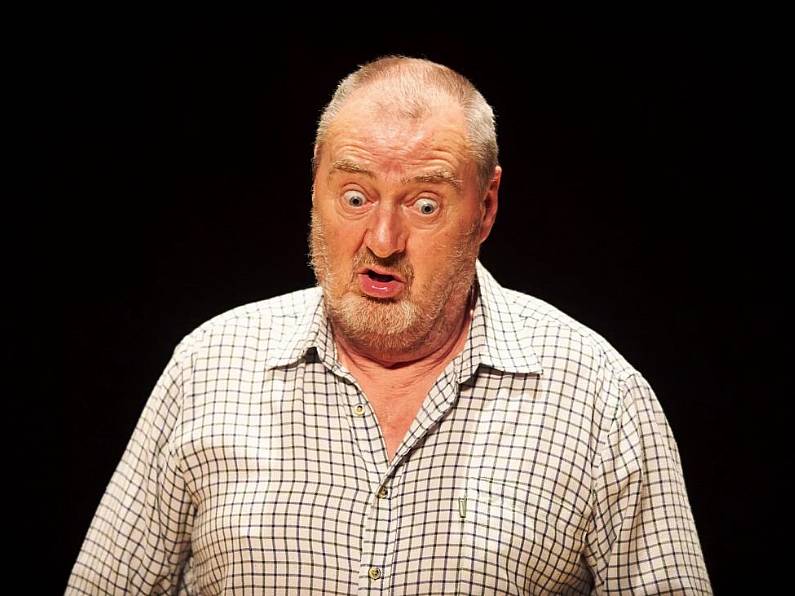

Chief Economist at KBC Bank, Austin Hughes, said: "The steady sentiment reading for December reflects very unstable economic circumstances at the turn of the year.

Irish consumers were notably gloomier about the economic outlook reflecting growing risks around Brexit but this was offset by optimism about household finances and increased seasonal spending plans.

"Like the broader economy, Irish consumer sentiment seems to be at a tipping point at present," he said.

"If a ‘no deal’ Brexit is avoided, there are strong grounds for optimism about 2019 as solid momentum in activity, employment and incomes should continue but if the UK crashes out of the EU in about eleven weeks’ time, the outlook will be markedly poorer.

"The sentiment index suggests Irish consumers are unclear as to whether they are far too cautious or far too complacent," he said.