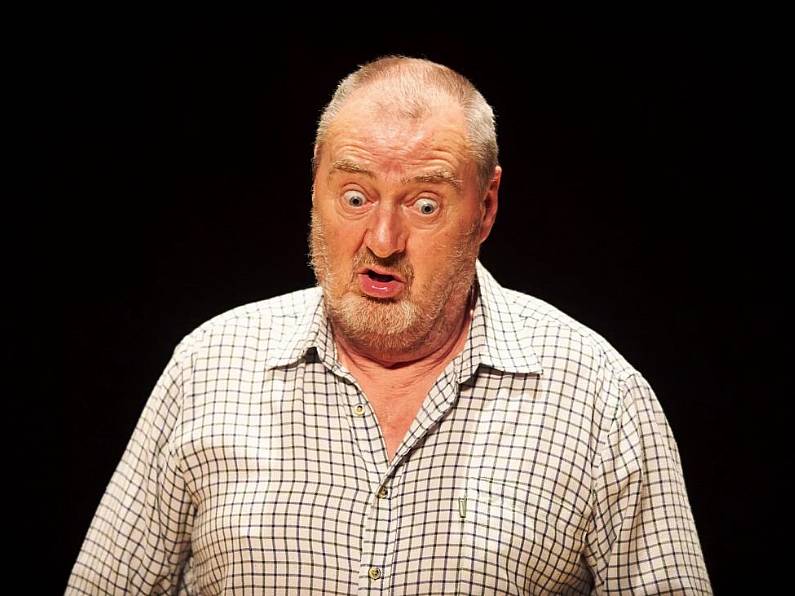

A measured step in the right direction but the exit tax for businesses applicable from midnight tonight may surprise some, is the budget verdict of Pádraig Cronin, Tax Partner and Vice Chairman at Deloitte,

Mr Cronin also suggested more could have been done to close the tax differential between employed and self-employed individuals.

“Budget 2019 is certainly a step in the right direction as the Minister focused on positioning the economy for future sustainable growth while simultaneously addressing a changing international tax landscape.”

Mr Cronin pointed out that an exit tax charge at 12.5% will apply to companies migrating out of Ireland which is effective from midnight tonight.

“Many companies would have been able to claim an exemption from tax prior to this change. This amendment to exit tax rules was unexpected considering that Ireland is not required to bring their domestic exit tax rules in line with EU ATAD standards until 1 January 2020 and this was a timeline many companies were working towards from a planning perspective.”

Mr Cronin also pointed out that Ireland is required to bring in Controlled Foreign Company Rules (CFC) as required by the ATAD from 1 January 2019 and Minister Donohue has confirmed this year’s Finance Bill will deal with this tax measure.

Mr Cronin welcomed the extension of the three year tax relief for certain start-up companies until the end of 2021 and the amendments to the increased limits to the share based remuneration scheme for SMEs, ‘KEEP’.

“These measures will be broadly welcomed by businesses and the amendments to the KEEP scheme should provide a more effective tool for attracting and retaining key staff.

"While some measures were taken to reduce the personal tax burden for workers, and close the tax differential between employed and self-employed individuals, there is more that needs to be done to overhaul the personal tax system and reduce marginal tax rates.

"Budget 2019 took a step in the right direction today; but more tangible measures need to be urgently taken rather than slight changes annually,” he said.