Petrol, diesel, cigarettes and the hotel Vat rate are all going up in next week's Budget.

It comes as final negotiations take place ahead of Budget day on October 9.

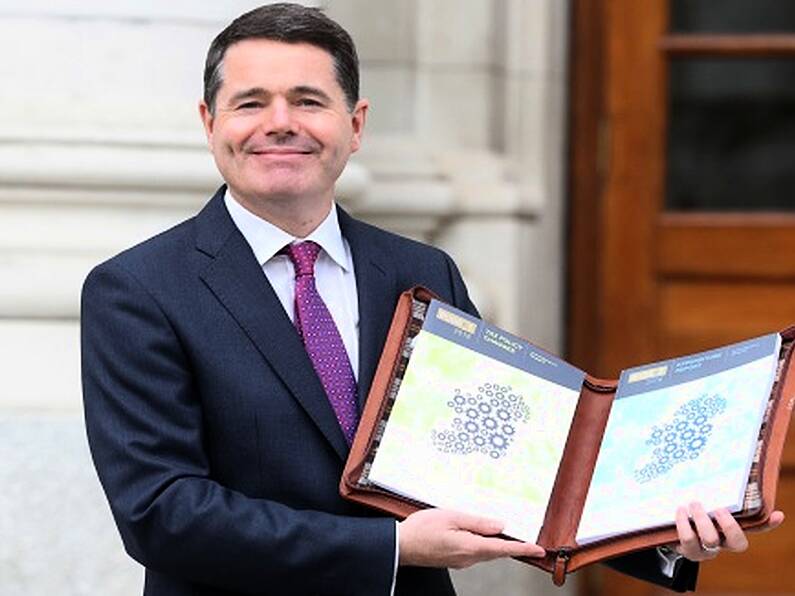

Finance Minister Paschal Donohoe is understood to be looking at a carbon tax to help fund social welfare hikes and income tax cuts.

It means the cost of home heating and motoring will rise next year, while, Excise duty on cigarettes will also increase.

Minister Donohoe will give himself another €100m to play with by reducing mortgage interest relief for 300,000 homeowners and hiking education levies paid by businesses.

The 9% Vat rate on hotels, B&Bs, and restaurants is to increase by at least two percentage points in next week’s budget, in a bid to raise over €520m, according to the Irish Examiner.

Amid tense negotiations between Fine Gael and the Independent Alliance, Finance Minister Paschal Donohoe is resisting calls to limit the increase to larger hotels in Dublin, Cork, and Galway, who some ministers say have “disgracefully” sought to gouge customers.

The retention of the 9% Vat rate has been in doubt for some time amid reports of city-centre hotels charging in excess of €300 a night per room while benefiting from the reduced Vat rate.

The alliance — comprising Shane Ross, Finian McGrath, John Halligan, and Kevin ‘Boxer’ Moran — is said to be “deeply unhappy” at Mr Donohoe’s proposed hike on all parts of the tourism sector.

Alliance members sought to have a levy imposed on larger hotels charging over €150 per room per night, but Mr Donohoe ruled that out, according to sources.

Mr Donohoe and his officials have said it is not possible to target those larger hotels by themselves, and is looking to increase the Vat rate — lowered in 2011 to stimulate the sector — across the board.

This means hotels, large and small, guesthouses, B&Bs, restaurants, and bars will now be hit by a Vat rate of at least 11%.

"This was only ever a temporary measure to help a struggling sector,” said one Fine Gael minister. “It has clearly worked and the money is more useful elsewhere now. The public will understand that.

The Irish Examiner understands that targeting the Vat increase at large hotels only would raise about €150m next year, but Mr Donohoe is adamant the whole sector will be hit, in order to raise €526m to pay for increased spending plans.

A full reversal of the Vat rate to 13%, according to Government sources, would raise in excess of €600m, meaning to achieve the €526m target, Mr Donohoe is looking at increasing it to 11%.