Want to know what Budget 2021 will mean for you?

Budget day is here and we’ll be feeding you up to the minute updates on the facts & figures that matter most to you.

KEY POINTS//

Motoring

Tax rises on fuel and on high-emissions new cars on a major overhaul of the tax regime for motorists.

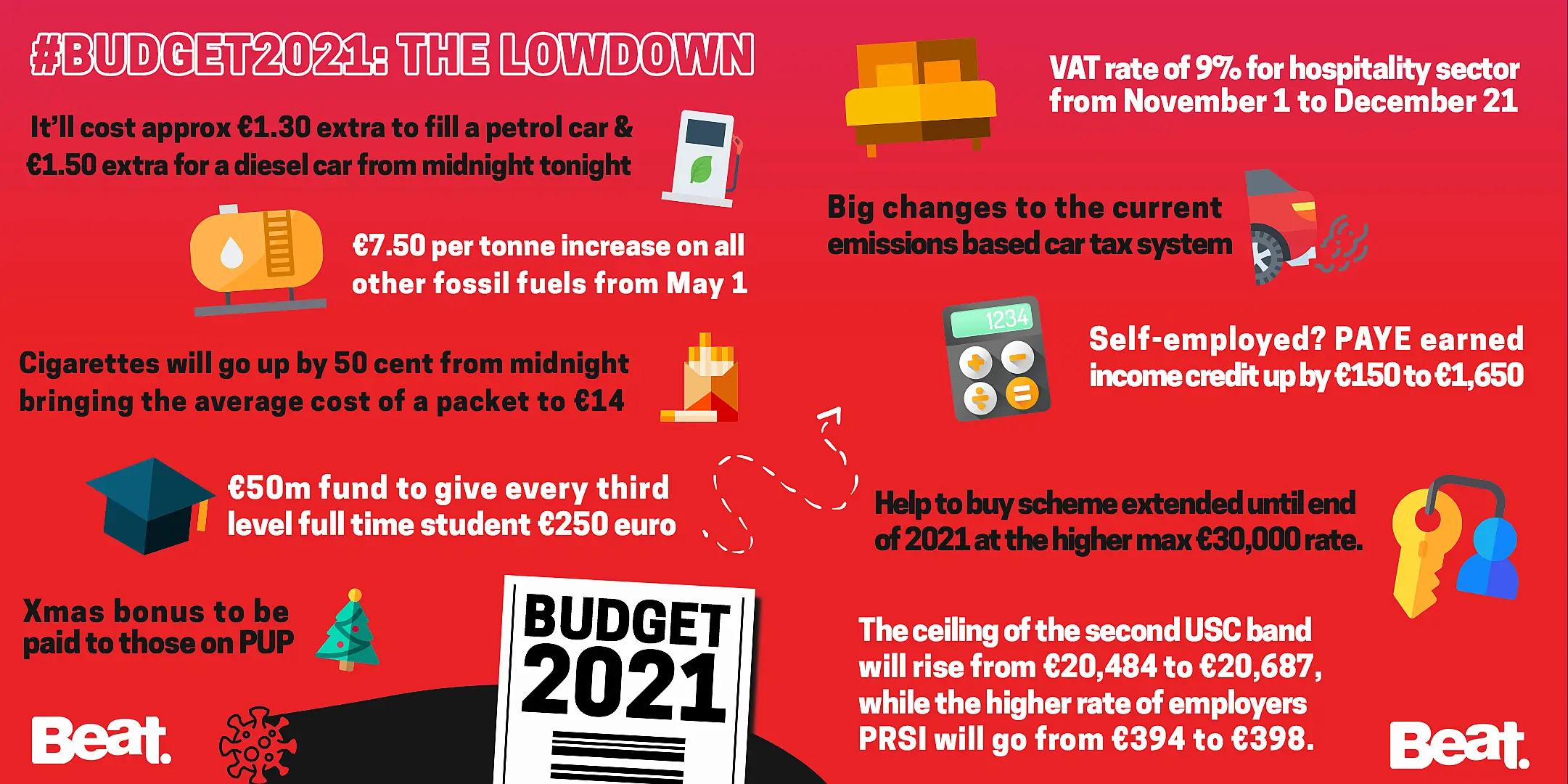

From midnight, the increase in carbon tax by €7.50 per tonne will mean a €1.51 (approx) rise in the cost of a 60 litre fill of diesel and €1.30(approx) for a similar amount of petrol.

There will be an adjustment to the current emissions-based tax system to allow for the new international testing regime that aims to offer more realistic emissions ratings for all cars.

On motor tax on new cars, the number of VRT tax bands will rise from 11 at present to 20, applying to all new car sales from January 1st. He has also adjusted the NOx surcharge bands, a tax that applies to all new cars and used imports.

A new system, known as WLTP [Worldwide Harmonised Light Vehicles Test Procedure] will help to reform the annual motor tax regime.

Currently cars first registered prior to July 2008 are rated by engine size, while those rated after then have been taxed based on NEDC emissions ratings. A third table of taxes based on WLTP ratings will apply to all new cars - and used imports - first registered from January 1st.

The current electric and plug-in hybrid allowances will expire at the end of this year.

Home Heating

Fuel allowance up by €3.50 a week to €28.

Carbon tax increase of €7.50 a tonne from May 1st 2020. Will include items such as coal, briqeuttes and home heating fuel/gas.

Welfare:

Xmas bonus to be paid to those on PUP and other welfare if they've been on that for 4 months instead of usual 15.

Rise in the pension age to 67 on January 1st, 2021 has been scrapped.

People working from home may claim tax deductions for the cost of their employment, including the cost of electricity, lighting and broadband.

€50m fund to give all third level full time students €250 euro

Tobacco

Cigarettes will go up by 50 cent, bringing the average cost of a packet to €14.

Taxation

The ceiling of second USC band will rise from €20,484 to €20,687.

The weekly threshold for the higher rate of employers PRSI will go from €394 to €398.

For the self-employed, Mr Donohoe said he would equalise the earned income credit with the PAYE credit by raising it by €150 to €1,650.

Business

Reduced VAT rate of 9% for hospitality sector from November 1st until December 2021.

Businesses hit by the pandemic will be able to avail of a Covid Restrictions Support Scheme (CRSS). The scheme will be subject to a maximum weekly payment of €5,000 and will be calculated on the basis of 10 per cent for the first million euro of turnover, and 5 per cent thereafter.

LIVE BLOG//

14:30: Fuel allowance up by €3.50 a week to €28.

14:27: 620 new Garda recruits & 500 new civilian staff to come on board.

14:26: Xmas bonus to be paid to those on PUP and other welfare if they've been on that for 4 months instead of usual 15.

14:25: Self-employed on PUP can take up some freelance work and not lose their benefit.

14:24: The planned pension age increase in Jan 2021 won't proceed.

14:23: Parents Benefit to be extended by a further three weeks.

14:21: €50m for live entertainment supports and arts council funding to increase it to 130m.

14:20: €55m for a tourism business support scheme and 5 million for tourism product development

14:17: An extra €2 a week to "reduce child poverty” if your child is under 12, that rises to €5 if the child is older than 12 years of age.

14:12: €5.2 billion for Dept of Housing: an increase of €773 million on 2020's figure. Includes €65m for deep retrofitting of existing social housing and €110m for affordable housing package for affordable and cost rental.

14:10: €132 million for the National Broadband Plan

14:09: Purchase of 41 additional InterCity railcar carriages and sign contract with the potential for up to 600 electric carriages as part as DART+.

14:08: €100m for new disability services.

14:07: €8 million in additional funding on mental health services.

14:04: An extra 1,146 acute beds, an increase in critical care beds to 321 by end of 2021 from 255 pre-COVID. 1,250 community beds in 2021 including 600 new rehabilitation beds

14:02: Extra four billion euro in funding for the HSE.

No one could have predicted the year that we have just had. I want businesses and workers to know that as we face into more uncertain times, the Government is here for you and on your side #Budget2021

— Leo Varadkar (@LeoVaradkar) October 13, 2020

14:01: Ireland has signed up to EU advance purchase agreements for potential COVID vaccines

14:00: €340 million will be spent on Brexit in 2021. That includes funding for ports and airports. Brexit funds to hire 1,500 staff and upgrades at ports and airports ahead of 31 December were also announced, includes Rosslare

13:59: Minister McGrath announces an additional €20m for voluntary disability service providers.

13:46: People working from home may claim tax deductions for the cost of their employment, including the cost of electricity, lighting and broadband.

13:45: There will be an increase in the price of cigarettes by 50c on average. €14 now for most popular pack of cigarettes

13:44: Price of alcohol to remain unchanged.

13:40: Changes to the motor tax regime. Rates unchanged for those before 2008. Most pollutant cars impacted most.

This is new. Donohoe says the Finance Bill will legislate for a carbon tax hike of €7.50pa every year until 2029, and €6.50 in 2030, to achieve €100 per tonne.

Avoids the need for future annual votes in Dáil - it'll be baked into law already. A Green win in #budget2021

— Gavan Reilly (@gavreilly) October 13, 2020

13:39: Changes to VRT based on emissions which is aimed at incentivising people to buy low emission cars.

13:35: The carbon tax will increase by €7.50 every year out to 2029 and then by €6.50 in 2030 to achieve €100 per tonne.

13:35: Carbon tax increases by 7.50 a tonne from midnight.

View this post on Instagram

13:34: Help to buy scheme extended until end of 2021 at the higher max 30,000 euro rate.

13:31: No broad changes to income tax credits or bands. The ceiling for the second USC rate adjusted up to €20,687. The weekly threshold for the higher rate of employers PRSI will go from €394 to €398. Self-employed income tax credit to rise by €150 to €1650.

13:30: Increase in the Dependent Relative Tax Credit by €70 to €245

13:25: VAT for hospitality will be reduced to 9% from November 1st until December 2021

13:23: There will be a new COVID restrictions support scheme to provide targeted support for businesses that have temporarily closed because of the pandemic. This scheme will operate when level three or higher is in place. The payments will be based on their 2019 weekly turnover. The scheme will be effective from today until March 31st. First payments mid-November.

13:22: Temporary Wage Subsidy Scheme will be needed out to the end of 2021.

13:21: GDP is projected to decline by 2.5% for the year as a whole, with domestic demand falling by 6%.

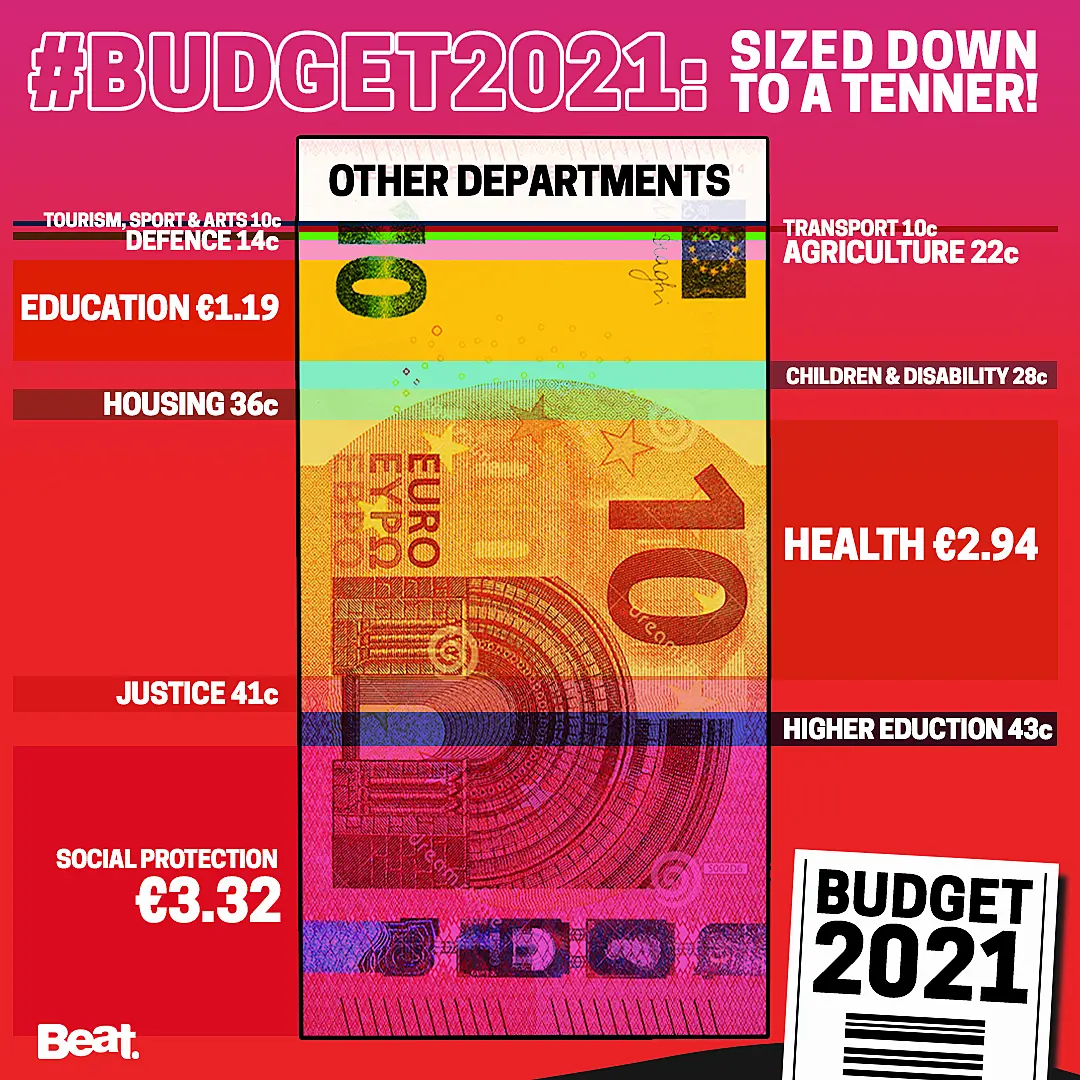

13:19: Total budget package will be 17.75 billion euro. 17 billion in expenditure and 270 million in taxation, 8.5bn on public services including 2.1bn on contingency funding. Capital spending to increase by 1.6bn

13:18: There will be a 3.4 billion euro recovery fund. This will be aimed at increasing employment.

13:15: Ireland expected to run 6.2% (21.5 billion euro) deficit for 2020.

13:13 Government is forecasting a total of 320,000 job losses in 2020 with 155,000 of those being recovered in 2021

13:10: Supports for Budget 2021 total €24.5 billion.